)

In January 2023, BharatPe co-founder Bhavik Koladiya alleged that he transferred 1,611 shares of BharatPe, amounting to Rs 88 lakh, to Grover but was never paid for them

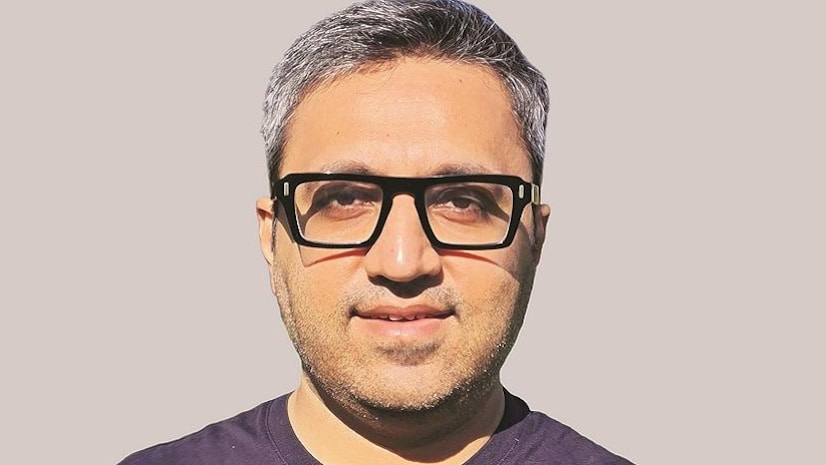

Fintech firm BharatPe has reached a settlement with its former co-founder Ashneer Grover, days after the Delhi Police’s Economic Offences Wing (EOW) arrested Grover’s brother-in-law in a case related to the misappropriation of funds at the company.

The settlement ends years of legal disputes between the co-founder and the company.

Click here to connect with us on WhatsApp

As part of the settlement, Grover will no longer be associated with BharatPe in any capacity nor be part of the company’s shareholding.

“Certain shares of Mr. Grover shall be transferred to the Resilient Growth Trust for the benefit of the company, and his remaining shares will be managed by his family trust. Both parties have decided not to pursue the cases filed,” BharatPe said in a statement.

Consequently, Grover will no longer be part of the Gurugram-based company’s capital table in the future.

“I have reached a decisive settlement with BharatPe. I repose my faith in the management and board, who are doing great work in taking BharatPe forward in the right direction,” Grover said on social media platform X (formerly Twitter).

BharatPe and Grover had been embroiled in years-long legal disputes.

In January 2023, BharatPe co-founder Bhavik Koladiya alleged that he transferred 1,611 shares of BharatPe, amounting to Rs 88 lakh, to Grover but was never paid for them.

The matter later went to court.

Following a criminal complaint by BharatPe regarding the misappropriation of funds in 2022, the EOW filed an FIR against Grover, his wife Madhuri Jain, and other family members in 2023.

The fraud, amounting to Rs 81 crore, allegedly involved misappropriation of funds through illegitimate payments to fake human-resource consultants, inflated and undue payments to pass-through vendors, bogus transactions in input-tax credit, and the payment of penalties to Goods and Services Tax (GST) authorities, as well as illegal payments to travel agencies, among others

First Published: Sep 30 2024 | 11:08 AM IST

Leave a Reply