The National Stock Exchange (NSE), former managing director and chief executive officer Vikram Limaye, and eight others have settled the case pertaining to the misuse of the trading access point (TAP) by agreeing to pay a settlement amount of Rs 643 crore.

In the TAP matter, the market regulator had issued a show-cause notice to the exchange in February 2023 following its findings that there was a possibility of a system bypass by brokers and that NSE did not take appropriate remedial steps.

Click here to connect with us on WhatsApp

TAP refers to a software application deployed by NSE and used by stock brokers to establish communication (orders/trades) with its trading system. It was launched in 2008 and continued until September 2019 for the equity segment. The exchange had introduced ‘Direct Connect’ as an alternative to TAP in 2016.

The exchange had filed a settlement application before the regulator first in 2023 and then a revised application in August 2024.

Under the settlement proceedings norms, matters can be settled without admitting or denying the findings by the regulator. The settlement amount is determined by a high-powered advisory committee (HPAC) and later approved by a panel of whole-time members (WTMs) of Sebi.

“The panel of WTMs accepted the recommendations of the HPAC to settle the matter on composite payment by NSE for an amount of Rs 643 crore,” said the settlement order.

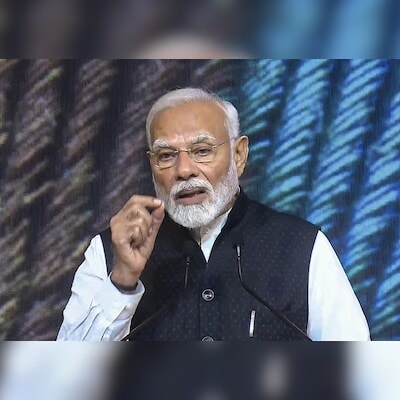

In the order, Sebi whole-time member Ashwani Bhatia has also directed the former executives to do pro bono community service of at least 14 days in the current financial year.

The resolution of key legal proceedings will help NSE push ahead with its much-awaited initial public offering (IPO). The exchange has also applied for a no-objection certificate (NOC) with Sebi for approval to file IPO documents.

Last month, Sebi dropped charges against NSE and its seven former executives, including Chitra Ramkrishna, Ravi Narain, and Anand Subramanian, in the co-location case, citing an absence of evidence to support the allegations.

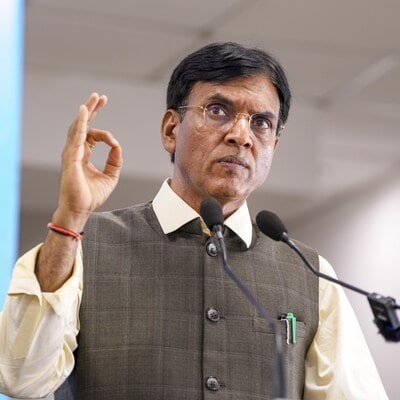

In its order, Sebi whole-time member Kamlesh Varshney noted that while there were certain lapses at NSE’s colo facility, there was no evidence to establish any “collusion” or “connivance” with stock broker OPG Securities, who had gained “unfair” access to the exchange’s secondary server.

First Published: Oct 04 2024 | 6:31 PM IST

Leave a Reply