)

HDFC Bank on Friday said that the sequential rise in deposits outpaced loan growth. (Photo: Shutterstock)

India’s biggest private lender HDFC Bank on Friday said that the sequential rise in deposits outpaced loan growth in the fiscal second quarter.

The Mumbai-based bank’s gross advances, or loans sanctioned and disbursed, rose 1.3 per cent to Rs 25.19 trillion ($300 billion) in the quarter ending September following a 0.8 per cent decline in the previous quarter.

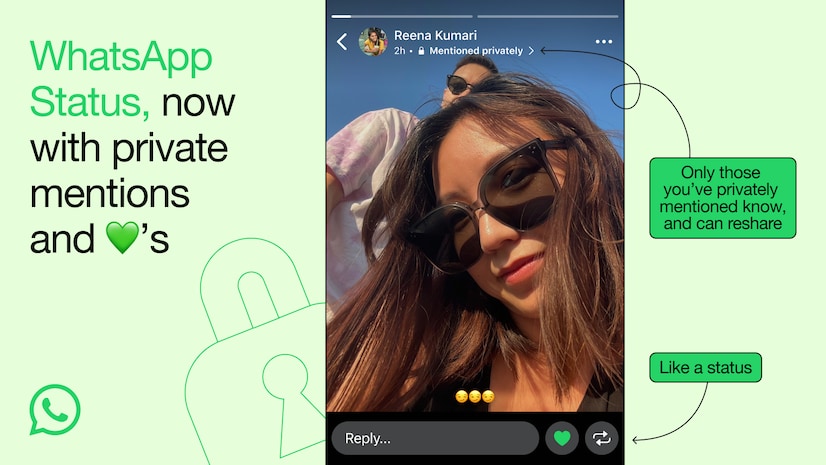

Click here to connect with us on WhatsApp

Retail loans grew by around Rs 33,800 crore while commercial and rural banking loans grew by around Rs 38,000 crore from a quarter earlier, HDFC Bank said in a statement.

Corporate and other wholesale loans fell Rs 13,300 crore from a quarter earlier, it said.

Deposits rose 5.1 per cent from the previous quarter to Rs 25 trillion, after no sequential change in April-June.

Aggregate low-cost current account and savings account deposits rose 2.3 per cent.

HDFC Bank merged with parent HDFC in July 2023, with the deal adding a large pool of loans to its portfolio, but a much smaller amount of deposits.

As a result, the bank’s loan-to-deposit ratio (LDR) rose to around 110 per cent after the merger, putting it under pressure to increase the pace at which it raises deposits or to slow loan growth.

LDR is a metric used by banks to assess their liquidity position by assessing whether they have enough deposits to fund loan growth.

HDFC Bank had said in July that it aimed to bring down the LDR in the coming quarters as deposits would grow faster than loans.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Oct 04 2024 | 10:03 AM IST

Leave a Reply